Intraday Auctions on SIDC

The Goal of IDAs

Pricing the intraday capacity - via Intraday Auctions (IDAs) - is part of the Single Intraday Coupling (SIDC) and it completes the SIDC market which was before solely based on the continuous trading method. IDAs were implemented across Europe on 13 June 2024, to allow for the pricing of cross-border capacity in the intraday timeframe.

The purpose of introducing the intraday auctions is to harmonize the calculation and allocation of cross-border capacities on the intraday market and to price intraday cross-border capacities to reflect their shortage at a given time and thereby send an adequate price signal to the market.

Intraday auctions provide the ability to accumulate offers and efficiently allocate the scarce transmission capacity. This is a novelty in the intraday timeframe, since capacity in the continuous intraday trading is allocated on a first-come first served basis. IDAs are the first intraday auctions involving most of the European countries.

IDAs were introduced in Austria, Belgium, Bulgaria, Czechia, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Luxemburg, The Netherlands, Norway, Poland, Portugal, Romania (the borders are not yet included), Slovakia, Slovenia, Spain, and Sweden.

The IDA Solution

IDAs are organized as implicit auctions where collected orders are matched, and cross-zonal capacity is allocated simultaneously for different bidding zone borders. IDAs take into account all valid orders submitted for the respective auctions and determine clearing prices for the relevant bidding zones based on matched orders.

Cross-zonal capacities cannot be allocated simultaneously for IDAs and for continuous trading along the same borders. Therefore cross-zonal capacity allocation within the continuous SIDC is suspended for a limited period during which the cross-zonal capacities are allocated via IDAs. Continuous intrazonal trading can only continue during the IDAs in those bidding zone where more than one NEMO is active.

IDA2: Gate Closure Time for market parties at D-1 22h. Allocated period D [0h-24h]

IDA3: Gate Closure Time for market parties at D 10h. Allocated period D [12h-24h]

How Does the Algorithm Work?

EUPHEMIA, i.e. the algorithm developed for SDAC, is used for the purpose of IDAs. The public description of EUPHEMIA (applicable to IDA and to SDAC) is available in the following link

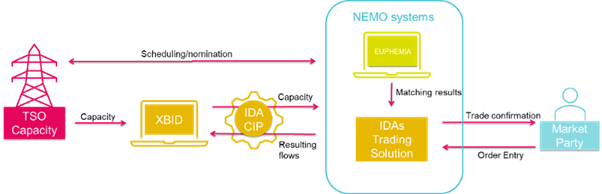

High-Level Architecture

- XBID is used as source of network constraints data for IDA (pre-coupling) and to validate the IDA results in terms of capacity meeting the network constraints (coupling).

- Network data are provided via NEMOs to EUPHEMIA (auction algorithm).

- IDA results are submitted to XBID to update the information about Already Allocated Capacity (AAC) in XBID and to reflect in relevant CMM files the existence of capacity reserved for IDA results.

- IDAs Trading Solution is the same solution as used for day-ahead being adapted for IDAs, depending on each NEMO.

- IDA CIP is an intermediate system (interface) between XBID and NEMO Systems.

Products & Order Types

IDAs solution supports hourly, half-hourly and quarter-hourly products.

However, for the time being simple orders of only one time resolution are allowed in each BZ.

Additional order types supported are simple block order and merit order.

Resources Available

- 2025 IDA weekly reports

- 2024 IDA weekly reports

Information Notes

- SIDC OPSCOM Report on Cancellation with Regards to the Intraday Auction 1 for Delivery Date 3 June 2025

- SIDC OPSCOM Report on Cancellation with Regards to the Intraday Auction 2 for Delivery Date 17 May 2025

- SIDC OPSCOM Report on Automatic Partial Decoupling with Regards to the Intraday Auction (IDA2) for Delivery Date 3 May 2025

- SIDC OPSCOM Report on Cancellation with Regards to the Intraday Auction 1 for Delivery Date 20 April 2025

- SIDC Announces the Launch of 15-Minute Products in Several Further Bidding Zones and Bidding Zone Borders

- SIDC OPSCOM Report on Cancellation with Regards to the Intraday Auction (IDA2) for Delivery Date 4 February 2025

- SIDC OPSCOM Report: Cancellation of Intraday Auction (IDA3) for Delivery Date 22 January 2025

- SIDC OPSCOM Report on Automatic Partial Decoupling with Regards to the Intraday Auction (IDA3) for Delivery Date 17 January 20255

- SIDC Announces the Launch of 15-Minute Products in Several Bidding Zones and Interconnectors

- MCSC Initiated an In-Depth Investigation of the Partial Decoupling of SDAC and Cancellation of SIDC IDA3 Taking Place on 25 June (Trading Date)

- European Energy Market Milestone: Intraday Auctions (IDAs) Successfully Implemented

- Intraday Auctions (IDAs) Were Implemented Across Europe on 13 June

- Confirmation of the Go-Live Date for Intraday Auctions (IDAs)

- IDA Pre-Launch Event Video

- IDA Pre-Launch Event MoM

- IDA Pre-Launch Event Presentation

- SIDC Held a Pre-Launch Event About the New Intraday Auction

- Information Package About Intraday Auction

- IDA Go-Live Pre-Launch Event – Agenda and Registration

- IDA Go-Live on Single Intraday Coupling (SIDC) - Pre-Launch Event Invitation Letter

ENTSO-E

ENTSO-E