Frequency Containment Reserves (FCR)

In accordance with the objectives of the COMMISSION REGULATION (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing (EBGL), the common market for procurement and exchange of FCR (FCR Cooperation) aims at the integration of balancing markets in order to foster effective competition, non-discrimination, transparency, new entrants and increase liquidity while preventing undue distortions. These objectives must be met in consideration of secure grid operation and security of supply.

This regional project currently involves twelve Transmission System Operators (TSOs) from nine countries. These are the TSOs from Austria (APG), Belgium (Elia), Switzerland (Swissgrid), Germany (50Hertz, Amprion, TenneT DE, TransnetBW), Western Denmark (Energinet), France (RTE), the Netherlands (TenneT NL), Slovenia (ELES) and Czechia (ČEPS).

Basic Principle

The Austrian, Belgian, Czech, Danish, Dutch, French, German, Slovenian and Swiss TSOs currently procure their FCR in a common market.

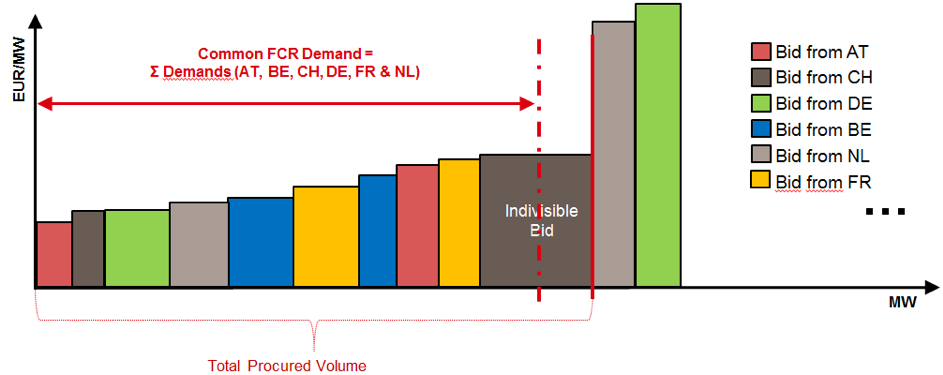

The FCR Cooperation works currently with daily auctions with four-hour symmetric products. The auction takes place every day and applies for the next delivery day. The FCR Cooperation is organized with a TSO-TSO-model, where the FCR is procured through a common merit order list where all TSOs pool the offers they received. The interaction with Balancing Service Providers (BSPs) and the contracts between the TSOs and BSPs are handled on a national basis along with the responsibility of delivery.

The process of market design evolution is based on a close cooperation between all the TSOs, NRAs and stakeholders of the involved countries.

Organisational structure

The decision-making body of the FCR Cooperation is the Steering Committee, chaired by one of its members based on a rotational basis. The Steering Committee steers the working groups and manages the interface with NRAs. Currently there are two working groups: the Market Expert Group, which addresses market related topics and the Technical Expert Group, which focusses on technical topics. They can be contacted via the contacts below

Historical evolution & Outlook

The FCR Cooperation was started in 2017 as a collaboration between the TSOs of Austria, Belgium, Germany, The Netherlands, and Switzerland. The FCR Cooperation can be joined by other countries and has grown considerably since its inception. France joined the cooperation in 2017, followed by Western Denmark and Slovenia in 2021. The Czech Republic joined in March 2023.

In 2017, FCR Cooperation TSOs submitted a proposal for future market design. This proposal is in accordance with Article 33 of the then recently established Electricity Balancing Guideline (EBGL) and was informed by a public consultation. The changes in market design outlined in the 2017 proposal have since been implemented. The finalized ‘Article 33 proposal’ forms the foundation of the FCR Cooperation, and is amended when needed.

As of 7th of September 2022, the FCR Cooperation included West Denmark as separate LFC Area in the Danish-Luxembourgish-German LFC Block in the algorithm. This step became necessary after West Denmark became its own LFC Area inside the LFC Block in summer 2022. Furthermore, a reduction of the Gate Opening Time from D-14 to D-7 was implemented. This change was publicly consulted between 25 May and 25 June 2021 as part of the Amended Article 33 proposal and approved by all respective regulatory authorities.

Consultations

FCR Cooperation TSOs regularly ask for feedback on proposals with public consultations. These can be found on the ENTSO-E consultation hub

Overview of the procurement principles of the FCR cooperation and implementation in the algorithm

Abbreviations

- BSP - Balancing Service Provider

- CBMP - Cross-Border Marginal Price

- CCS - Central Clearing System

- GCT - Gate Closure Time

- EBGL - Guideline on Electricity Balancing

- GOT - Gate Opening Time

- FCR - Frequency Containment Reserve

- LFC block - Load-frequency Control Block

- LMP - Local Marginal Price

- LMPe - Local Marginal Price of exporting country

- LMPi - Local Marginal Price of importing country

- SOGL - System Operation Guideline

- TSO - Transmission System Operator

1. Product information on FCR

The Austrian, Belgian, Dutch, Danish, French, German, Slovenian and Swiss TSOs currently procure their FCR in a common market. The product characteristics in the cooperation are defined as follows:

- Symmetric product (meaning that upward and downward FCR are procured together).

- Duration of product delivery: usually 4 hours, subject to daylight saving time shift.

- TSOs allow divisible and indivisible bids. Indivisible bids can have a maximum bid size of 25 MW in all the participating countries.

- Minimum bid size is 1 MW and resolution is 1 MW as well.

- In accordance with SO GL (Annex VI “Limits and requirements for the exchange of FCR”): Core shares and maximum transfer capacities (export limits) exist as limitations in the FCR market.

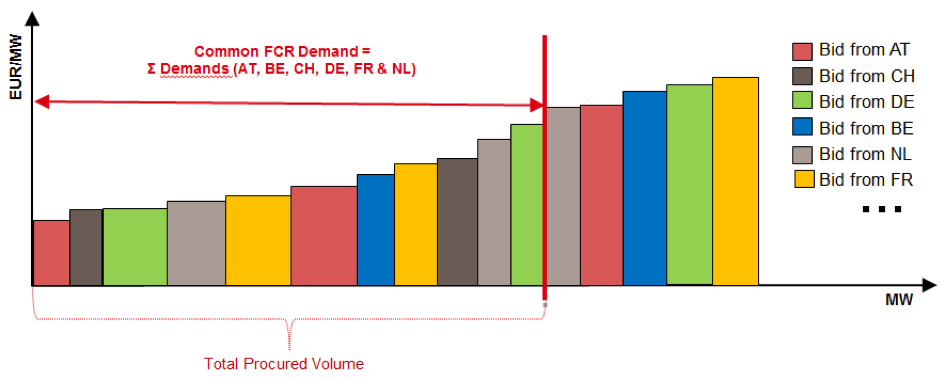

2. General optimisation principle

For each LFC Block a core share can be defined which represents the minimum volume of FCR which has to be procured from technical units of Balancing Service Providers (BSPs) within the borders of the LFC Block. For each LFC Block, an export limit is defined which indicates how much FCR can maximally be exported to other LFC Blocks of the cooperation. In addition there can be limits (“internal limits”) for the exchange of FCR between LFC Areas of the same LFC Block, which indicate how much an LFC Area can exchange with the other LFC Areas of the same LFC Block.

In this document, the internal limit is considered as an export limit, as it is the applicable case between Germany and Western Denmark. In general, the internal limit can be considered either as an import or an export limit between the LFC Areas of the same LFC Block.

All TSOs procure their required FCR demand in market-based tenders every day. Gate Opening Time (GOT) of the tenders is daily in D-7 at 11:00 CET. After Gate Closure Time (GCT) of those tenders (daily in D-1 at 08:00 CET), the bids of all TSOs are sent to the common optimisation algorithm. The optimisation algorithm calculates the optimal combination of FCR bids to be awarded under consideration of core shares, export limits of an LFC Block and internal limits for the exchange of FCR between LFC Areas of the same LFC Block with the goal to reduce total procurement cost of the cooperation.

First goal of optimization is to satisfy the required demand of all participating countries while respecting the mentioned limits. This is true even in some special cases which lead to over-procurement due to indivisible bids.

If no export limits or core share constraint are hit, one cross border marginal price (CBMP) will be determined equaling the most expensive awarded bid in the overall cooperation. Every BSP in the cooperation will therefore receive the same settlement price per MW and per duration of product delivery (usually 4 hours) for their awarded bids. Local marginal prices (LMP) of each country are in this situation equal to the CBMP (Cross Border Marginal Price).

Exceptions from having one CBMP may occur once export limits, internal limits between LFC Areas of the same LFC Block and/or core share constraint of one or more countries of the cooperation are hit. In this case, an LMP will be determined based on the local awarded bids within a country.

2.1 Case of hitting a limit constraint

It is important to understand that an export limit, internal limit or core share constraint is hit whenever it influences the solution and not only when the quantity awarded in an LFC Area or LFC Block is exactly equal to the respective limit quantity of that LFC Area or LFC Block.

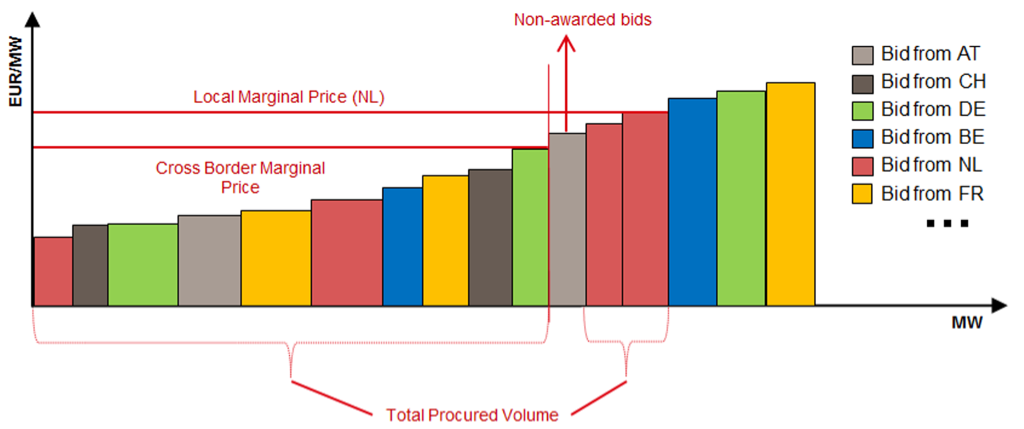

Case of hitting a core share constraint

If the core share constraint is hit, then the marginal price of this LFC Block is the price of the highest-priced awarded bid of this LFC Block (LMPi). This LMPi is always greater than or equal to the CBMP.

In the example below, the optimal solution without any constraints would have been to award the highest-priced bid from Austria. The optimal solution with the core share constraint in the Netherlands is to award the Dutch high-priced bids and the LMPi of the Netherlands is therefore determined by the awarded Dutch bid with highest price. In such a situation, there are non-awarded bids from other LFC Blocks with an offered price lower than the LMPi of the Netherlands.

There may also be situation were the awarded capacity within an LFC Block is above the core share constraint of that LFC Block and where the constraint is still considered as hit.

Let’s consider an example of the core share constraint in the Netherlands of 34 MW where there are 33 MW of low-priced bids in the Netherlands and an additional high-priced indivisible bid of 25 MW. The bid with high price would not be awarded if there was not a core share constraint. But with the core share constraint, the high-priced indivisible bid must be awarded and the total awarded quantity in the Netherlands would be 58 MW. The total awarded quantity would be far (24 MW) above the core share but still the core share constraint is hit and influences the solution. The LMPi in the Netherlands is set by the high-priced indivisible bid and is higher than the CBMP.

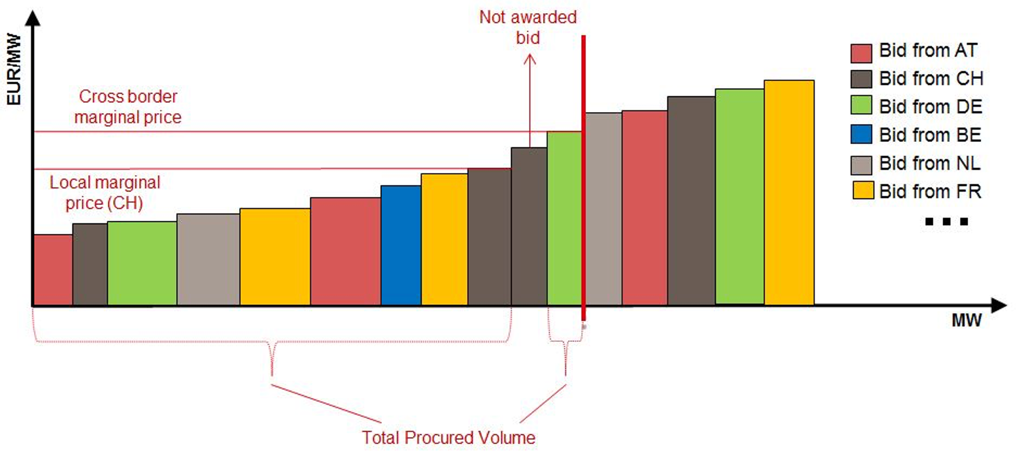

Case of hitting an export limit or internal limit for the exchange between LFC Areas of the same LFC Block

If the export limit of an LFC Block or the internal limit for the exchange between LFC Areas of the same LFC Block is hit, then the LMP of this LFC Block / LFC Area is the price of the highest-priced awarded bid of this LFC Block / LFC Area (LMPe). This LMPe is always lower than or equal to the CBMP.

In the following illustration, high volume of low-priced bids are available in Switzerland, and therefore a high FCR volume is awarded in Switzerland. The FCR volume of awarded bids is higher than local demand and the surplus is exported. However, one Swiss bid is not awarded due to the export limit, even though it is still offered at a lower price than the CBMP. The LMPe of Switzerland is consequently set at a lower level than the CBMP and equals the highest-priced awarded Swiss bid.

The same logic as the core share constraint applies for export limit of exporting LFC Blocks or for the limits for exchange between LFC Areas of the same LFC Block with low LMP while the export limit is not reached (but is hit). The reason for not reaching the exact limit values but still hitting the respective limits is due to the involvement of indivisible bids.

2.2 Case of several optimal solutions

If there is a set of equally optimal solutions to cover the demand of a country, the bids belonging to that country (own bids) have an awarding priority to the bids from other countries in order to avoid excessive cross-border exchange under consideration of previous requirements.

If then there is still more than one optimal solution, the bids which have been submitted first are awarded.

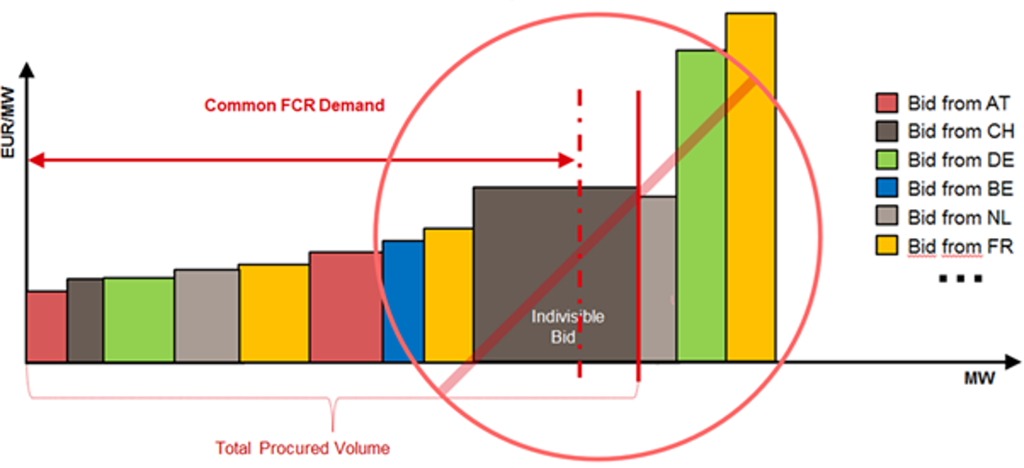

2.3 Divisible and indivisible bids

The optimization algorithm allows the declaration of two different types of bids: Divisible and indivisible bids. Indivisible bids can only be fully awarded or not awarded at all. For divisible bids, any quantity between zero and the offered quantity of a divisible bid can be awarded. The resolution of the awarded quantity is always 1 MW.

These two types of bids are treated differently by the algorithm in some special cases. Indivisible bids can be “paradoxically rejected” meaning that an indivisible bid is rejected although the offered price is lower than the LMP of the country where it is submitted.

This must not happen with divisible bids – divisible bids cannot be “paradoxically rejected”. As an example, if there are only two bids offered in country A (with a core share of 20 MW), a low-price divisible bid of 10 MW and an indivisible high-price bid of 20 MW, both bids have to be fully awarded in order to satisfy the core share (and avoid paradoxically rejected divisible bids).

Divisible bids are never paradoxically rejected i.e. divisible bids for which the offered price is lower than the LMP are always awarded (see figure below). The next bid after the indivisible bid cannot be rejected if it is divisible and has a lower price.

To sum up:

- Indivisible bids are only awarded if they improve the overall result of the optimisation outcome.

- Indivisible bids can be rejected if their awarding would not reduce the overall procurement cost and would lead to paradoxically rejected divisible bids. This rule also holds for bid sizes of 1 MW which are declared as indivisible by the BSP, even though such a bid complies with the minimum bid size and cannot be further divided.

Recommendation:

- Do not declare bids with a size of 1 MW as indivisible!

2.4 Case of over procurement because of an indivisible bid

The occurrence of indivisible bids can also lead to an over-procurement of the cooperation. If it minimises total procurement cost (pursuant to Article 58(3) and (4) EBGL) the total awarded quantity in a country can – in exceptional cases – be higher than the sum of its demand and export limit. However the quantity exceeding the sum of its demand and export limit cannot be used for the coverage of the total demand of the cooperation. In this case, the sum of all awarded volumes over all countries is larger than the total demand (over procurement). This is illustrated in the figure below where the indivisible bid is awarded because this results in lower overall procurement costs.

Special case of not hitting an export limit

An export limit may not be hit even if the quantity of awarded bids of a country is equal or above the sum of its demand and export limit (due to the acceptance of an indivisible bid). The export limit is not active in a country where all of the offered capacity has been selected (even if the selected capacity is equal or above the sum of its demand and export limit) in case the same capacity would be awarded also in case there was no limit. The limit is not active if it does not influence the solution which would be calculated without the limits.

2.5 Case of under procurement

Insufficient coverage of core share of an LFC Block

If a core share of an LFC Block cannot be covered by the total FCR volume of own bids, the core share shall be covered as much as possible with own bids. The rest of core share (which cannot be fulfilled by the own bids) remains as the deficit of FCR of that LFC Block. Remaining missing demands have to be procured locally and cannot be imported. For this local procedure additional local bids are needed and this local procedure is out of scope of this document.

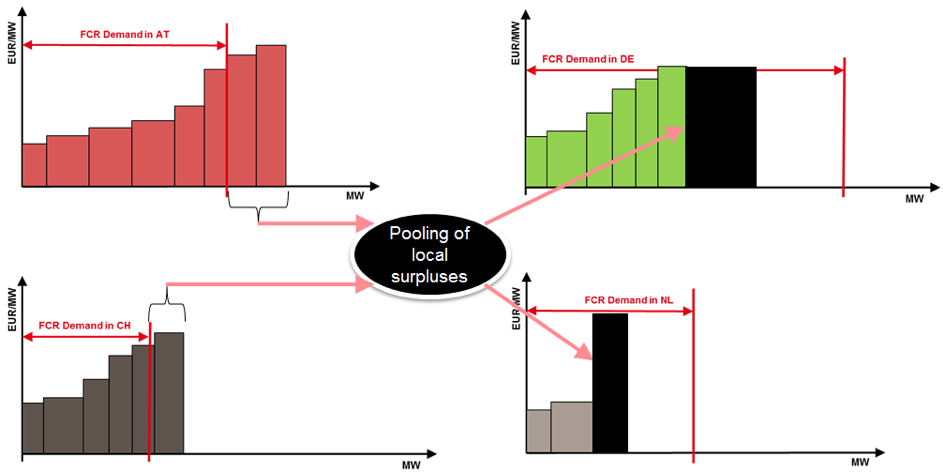

Shortfall of total FCR demand in the cooperation

If the total FCR demand of the cooperation cannot be covered by the total FCR volume of bids, all local bids are awarded to the LFC Block of the connecting TSO. If local surplus exists in some of the LFC Blocks, it is pooled and distributed among the LFC Blocks in deficit within the cooperation, proportionally to their demand. However, export limits and core shares must be still respected. Remaining missing demands have to be procured locally.

Contacts

In case you are interested in the FCR Cooperation or have any questions, please contact:

- Steering Committee and Expert Group PMO: Jiří Salavec

Press Releases and Updates

Consideration of responses to the public consultation on the Amended FCR Cooperation TSO’s Proposal

FCR market implementations: Announcement for delivery day 1 July 2020

Previous Press Releases and Updates

FCR values 2020 and Belgian full FCR procurement via FCR Cooperation

Updating the website with adding the section ‘Overview of the procurement principles of the FCR cooperation’ is added to the website and changing the TEG convener.

Go-live of daily auctions: First gate opening time today at 11 am for delivery day 1st July 2019

Stakeholder workshop on harmonisation and market implementations February 19, 2019 at ENTSO-E in Brussels

NRA approval for amended TSOs’ proposals was confirmed to all TSOs of the FCR Cooperation

Amended TSOs’ proposal for the establishment of common and harmonized rules and processes for the exchange and procurement of Balancing Capacity for Frequency Containment Reserves (FCR)

Amended TSOs’ Proposal for the exemption from the obligation to allow balancing service providers to transfer their obligations to provide balancing capacity

Updated Consultation report as two inconsistencies were detected and are corrected. Outlined corrections:

GOT D-14 (replacing statement of GOT D-5 )

Implementation D-1 daily auctions as of 01-07-2020 (replacing 01-12-2020)

Below TSO Proposals published on April 26, 2018 are not impacted by this.

TSOs’ proposal for the establishment of common and harmonized rules and processes for the exchange and procurement of Balancing Capacity for Frequency Contain-ment Reserves (FCR)

TSOs’ Proposal for the exemption from the obligation to allow balancing service providers to transfer their obligations to provide balancing capacity

Consulation report on TSO Proposals for FCR cooperation market design

Consultation on Proposal for FCR cooperation market design

Public consultation on “FCR Cooperation” potential market design evolutions

ENTSO-E

ENTSO-E